- 🚨GST Alert

CBIC Has issued important advisory for Specified Premises

issued important advisory for Specified Premises

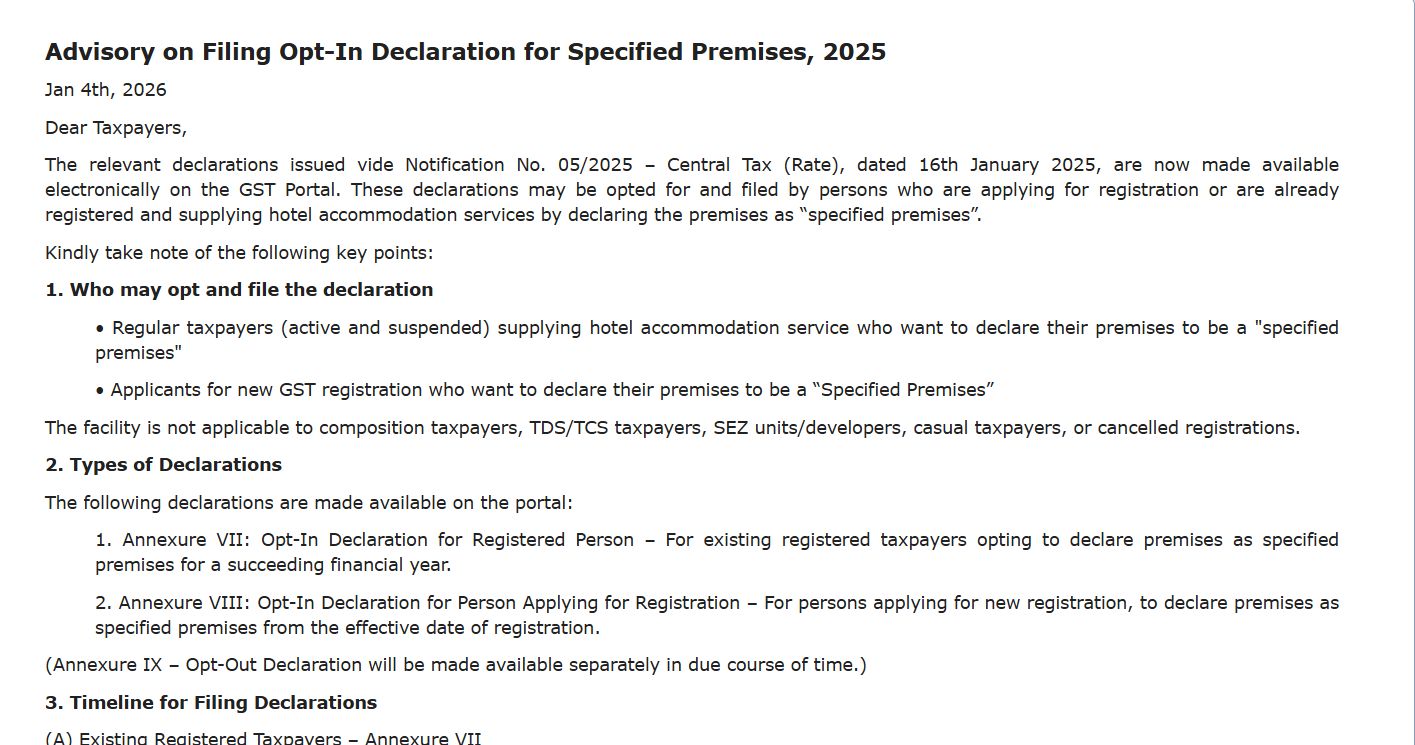

1. What’s the update?: –

Specified Premises – Hotel Accommodation (FY 2026-27)

GSTN has enabled online filing of Opt-In Declarations for declaring hotel premises as “Specified Premises”

📅 Advisory dated 4 Jan 2026

📜 As per Notification 05/2025 – CT (Rate)

2. Who can file this declaration?: –

✅ Regular GST taxpayers (Active / Suspended) supplying hotel accommodation

✅ Applicants for new GST registration

❌ Not allowed for:

• Composition dealers

• TDS/TCS taxpayers

• SEZ units/developers

• Casual taxpayers

• Cancelled GSTINs

3. Types of declarations available: –

📄 Annexure VII – For existing registered taxpayers (for next FY)

📄 Annexure VIII – For new registration applicants

🚫 Opt-Out (Annexure IX) will be enabled later

4. Filing window – VERY IMPORTANT ⏰: –

👉 Existing taxpayers (Annexure VII)

🗓️ Window: 1 Jan – 31 Mar of preceding FY

📌 For FY 2026-27 → 01.01.2026 to 31.03.2026

5. New GST applicants (Annexure VIII): –

⏳ File within 15 days from ARN generation

✔️ Even if GSTIN not yet allotted

❌ If application rejected → declaration NOT allowed

After 15 days ➝ wait for Jan–Mar window

6. How to file on GST Portal?: –

🔐 Login →

Services → Registration →

Declaration for Specified Premises

✔️ Select premises

✔️ Submit via EVC

📌 ARN generated on success

7. Key compliance points 🚨: –

• Max 10 premises per declaration

• Multiple declarations allowed

• Separate reference number for each premise

• Suspended GSTINs can file

• Cancelled GSTINs cannot

8. One-time opt-in = future continuity: –

Once opted, the status continues for future years

👉 Unless you file Opt-Out (Annexure IX) within prescribed time

9. Special note for FY 2025-26 filers: –

⚠️ Those who filed manually last year MUST re-file online

📅 File Annexure VII again for FY 2026-27

🗓️ Between 1 Jan – 31 Mar 2026

10. Key Point: –

🏨 Hotel accommodation providers:

✔️ Review your premises

✔️ File Annexure VII on time

❌ Missing the window may impact GST rate applicability