In the ever-evolving world of taxation and logistics, the E-Way Bill stands as an essential tool for facilitating smooth transportation and preventing tax evasion. Introduced under the Goods and Services Tax (GST) framework in India, the E-Way Bill system helps track the movement of goods across state and national borders. In this blog, we’ll dive deep into the E-Way Bill, its importance, the process of generation, recent updates, and answers to common queries.

What is an E-Way Bill?

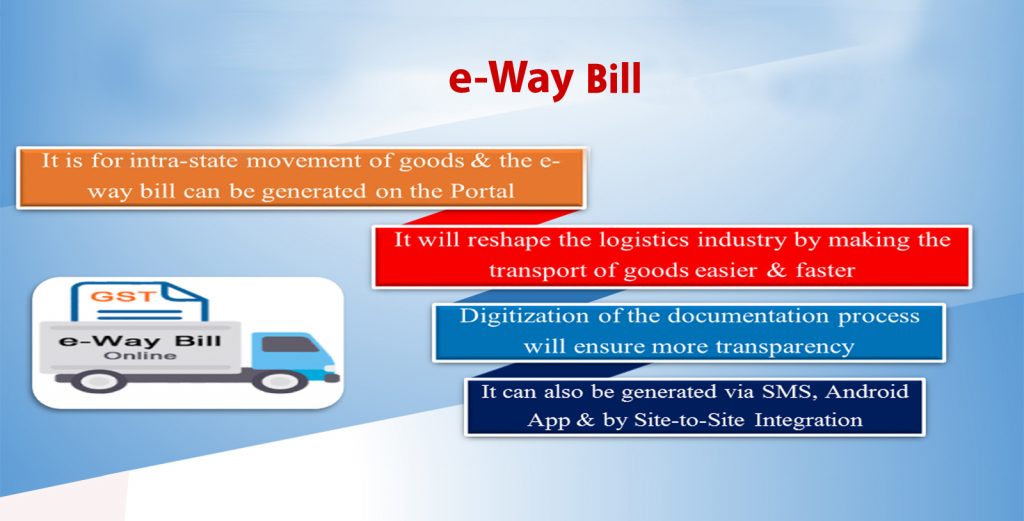

The E-Way Bill (Electronic Way Bill) is a document required for the movement of goods valued over a certain threshold. The bill is generated electronically through the GST portal, and it is mandatory for the transport of goods worth over ₹50,000. This document contains details about the goods being transported, such as the invoice number, consignor, consignee, and vehicle information.

An E-Way Bill serves several functions, including:

- Proof of Goods in Transit: It acts as proof of the movement of goods and facilitates the transportation process.

- Compliance with GST: It ensures that goods being moved comply with the Goods and Services Tax regime and avoids tax evasion.

- Prevents Malpractices: By tracking the movement of goods, it prevents unauthorized or illegal activities during transport.

Key Features of the E-Way Bill System

- E-Way Bill Number: Upon generating the bill, a unique E-Way Bill Number (EBN) is created, which is required to be carried during transportation.

- Validity: The validity of the E-Way Bill depends on the distance the goods need to travel. For instance:

- 1 day for every 100 km for regular goods.

- Special rules apply for certain items like heavy machinery or hazardous materials.

- Multiple Mode of Transport: The E-Way Bill can be used for goods moved by road, rail, air, or water, as long as the movement crosses state borders.

- Compliance for Both Inter-State and Intra-State Transactions: The bill is applicable for both intra-state and inter-state transport, but each state may have specific compliance rules.

How to Generate an E-Way Bill?

Generating an E-Way Bill is a simple process through the GST portal. Here’s a step-by-step guide:

- Login: Visit the official GST portal and log in with your credentials.

- Enter Details: In the E-Way Bill section, select “Generate New E-Way Bill”. Enter the relevant details of the goods being transported, including:

- GSTIN of the consignee and consignor.

- Vehicle number or transporter details.

- Goods description, quantity, and value.

- Generate E-Way Bill: After entering all details, click on Generate. A unique E-Way Bill Number (EBN) will be generated.

- Download/Print: You can download or print the E-Way Bill and carry it during transportation. The bill must be available for inspection by authorities when requested.

E-Way Bill for Different Types of Goods

While E-Way Bills are generally required for all taxable goods, there are certain exceptions:

- Exempted Goods: Goods like fresh produce, fruits, vegetables, and certain non-taxable items are exempt from the requirement of an E-Way Bill.

- No Bill Required for Small Consignments: If the value of goods does not exceed ₹50,000, an E-Way Bill is not needed, although some state governments may have their own thresholds.

- Special Cases: In some cases, such as transportation of goods by a transporter under a specific arrangement, an E-Way Bill might not be required.

Recent Updates on the E-Way Bill System

As of 2024, there have been several updates and improvements to the E-Way Bill system to enhance ease of use and improve compliance:

- Enhanced Integration with GST Portal: The E-Way Bill system has been integrated more deeply with the GST portal. This allows for faster updates and better compliance tracking.

- Tracking with QR Code: A QR code has been introduced for easy scanning, making it faster to verify the authenticity of the E-Way Bill at checkpoints.

- Mobile App for E-Way Bill Generation: The E-Way Bill app has been enhanced, enabling businesses to generate and verify bills directly from their mobile devices. This has simplified the process for small and medium-sized enterprises (SMEs).

- Shorter Validity Periods for Certain Goods: Based on transportation needs, the validity periods for certain goods have been updated, requiring users to be more vigilant about the time frames.

- Penalty for Non-Compliance: The government has increased penalties for non-compliance with E-Way Bill rules. This includes both fines and detainment of goods that are not accompanied by the required documentation.

- E-Way Bill for Return Shipments: New provisions have been introduced for generating E-Way Bills for goods being returned to the seller.

E-Way Bill Portal Features

- Bulk Generation: Users can upload large lists of goods to generate multiple E-Way Bills in one go.

- E-Way Bill Tracking: Track the status of goods and verify E-Way Bills using the portal.

- Alerts & Notifications: Get real-time notifications regarding the status of your E-Way Bill.

- Report Generation: The portal provides detailed reports on E-Way Bills generated, expiring soon, or rejected, making it easier to manage records.

E-Way Bill: Common FAQs

1. Is an E-Way Bill required for intra-state movement? Yes, it is mandatory for intra-state movement in many states, especially if the value of goods exceeds ₹50,000.

2. What happens if I don’t generate an E-Way Bill? If you fail to generate or carry the E-Way Bill while transporting goods, the authorities can impose penalties, seize the goods, or even initiate legal action.

3. How long is an E-Way Bill valid? The validity period depends on the distance. For example, for every 100 km, the E-Way Bill remains valid for one day.

4. Can I cancel an E-Way Bill? Yes, you can cancel an E-Way Bill within 24 hours of generation, as long as the goods have not been moved.

Conclusion

The E-Way Bill system is a crucial tool for modern logistics and GST compliance. As businesses continue to grow and expand, staying up-to-date with the rules, processes, and recent updates is essential to avoid penalties and streamline operations. By understanding the mechanics of the E-Way Bill and making full use of the available resources, businesses can ensure a smooth and efficient flow of goods across India.

1 comment so far